Short term capital gains calculator

Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. This is done to encourage investors to hold investments for a longer period of time.

Rsu Taxes Explained 4 Tax Strategies For 2022

Our calculator can be used as a short-term capital gain calculator by selecting the duration of the investment.

. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Find a Dedicated Financial Advisor Now. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Capital Gain Tax Calculator for FY19. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

Tax brackets change slightly from year to year as the cost of living increases. Now the difference is calculated if the sale price is more than the buying price capital gains tax is applicable. STCG on shares can be calculated with the help of this formula mentioned below STCG Sale value of an asset cost of acquisition expenses incurred in the course of transfersale cost of asset improvement In case of calculation of short term capital gains on equity shares cost of asset improvement is not applicable.

This calculator then subtracts the amount you paid to buy this asset. This formula yields a new basis of 2175000 which can be used to calculate the total long-term capital gains for the couples rental property. From 16092019 to 15122019.

The formula to calculate short-term capital gains is as follows - STCG full value consideration acquisition cost improvement cost transfer cost of an asset. What is a Capital Gains Calculator. This means that the tax rate can be anywhere from 10 to 37 depending on your household income.

Lets understand how to calculate short-term capital gains after selling a property using the formula mentioned above. With it you can also calculate your tax liability on capital gains earned from mutual funds and equity shares. Urban Catalyst is a leading Opportunity Zone Fund in Silicon Valley.

Use our capital gains calculator to determine how much tax you might pay on sold assets. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The grid below depicts the calculation of capital gains which you can use to compute the payable STCG Tax on.

The head Short Term Capital Gains refers to short term capital gains taxed as per the applicable income tax slab rate. 2022 capital gains tax rates. Fortunately you do not have to memorize the formula for calculating your 1031 exchange capital gains.

Short Term Capital GainS Other than covered under section 111A From 01042019 to 15062019. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Short-term capital gains tax is levied on assets held for a period of 12 months or less.

Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. Do Your Investments Align with Your Goals. If the sale price exceeds the shares purchase price the difference is the profit or capital gains earned on the sale of shares.

This is a simple free and easy-to-use online tool that shows you the STCG short-term capital gains or LTCG long-term capital gains depending on the holding period of your investment. Investments can be taxed at either long term. As a result the short-term capital gains rates for 2022 look slightly different than those for 2021.

Capital gains taxes on. Whether a gain is made from day trading or a capital asset held for just less than a year it falls into. Below you can find the 2022 short-term capital gains tax brackets.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. From 16062019 to 15092019. How to Calculate Short-Term Capital Gains.

The amount you can be taxed on the short-term capital gains depends on your income tax rate. First of all you provide the predetermined price of your asset this is the sale price any commissions paid or fees are not included in this. Short-Term Capital Gains Taxes.

2021 capital gains tax calculator.

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Meaning Types Taxation Calculation Exemptions

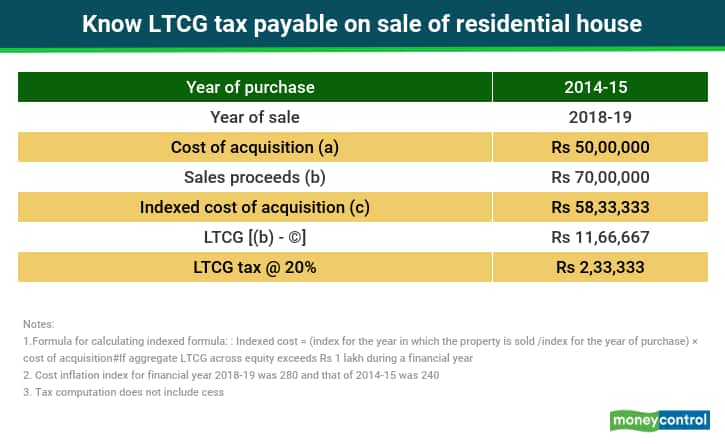

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

Short Term Vs Long Term Capital Gains White Coat Investor

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Long Term Capital Gain Tax Calculator In Excel Financial Control

Short Term Vs Long Term Capital Gains White Coat Investor

Guide To Calculating Cost Basis Novel Investor

Tax Calculator Estimate Your Income Tax For 2022 Free

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

The Tax Impact Of The Long Term Capital Gains Bump Zone

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Yield Cgy Formula Calculation Example And Guide

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

The Long And Short Of Capitals Gains Tax

Capital Gains Tax What Is It When Do You Pay It